What Is the Purpose of a Master Budget

The main purpose of a budget is to. A master budget is the name given to the full set of budgets prepared by a business for a period of time.

Difference Between Master Budget And Cash Budget Compare The Difference Between Similar Terms

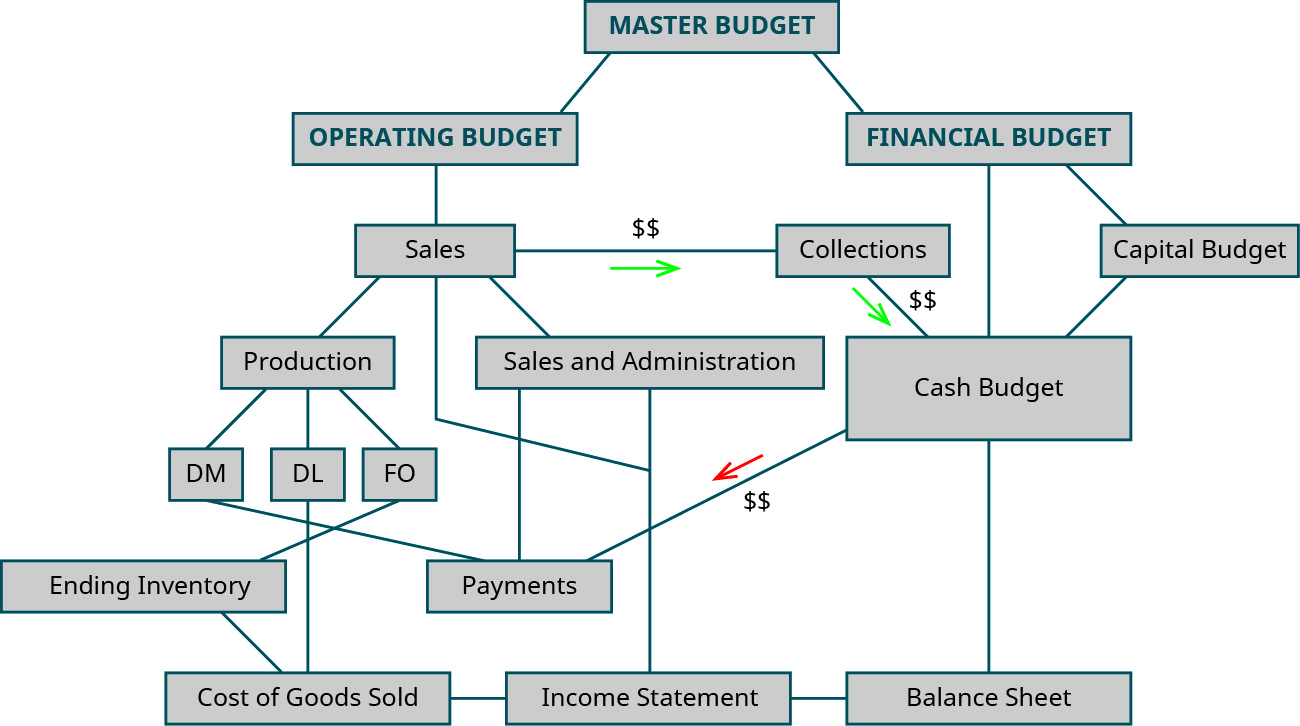

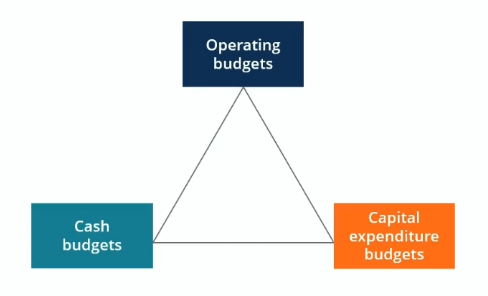

You can almost think of the master budget as a folder that includes all of the other budgets including.

. A master budget combines all of the smaller budgets within your business and turns them into one overall budget so you can get a comprehensive overview of your firms finances. 1The master budget is consolidated summary of the various functional budgetsit is also called summarised or finalised profit plan THe definition of this budget given by the charterd institute of management acco. The master budget is basically managements strategic plan for the future of the company.

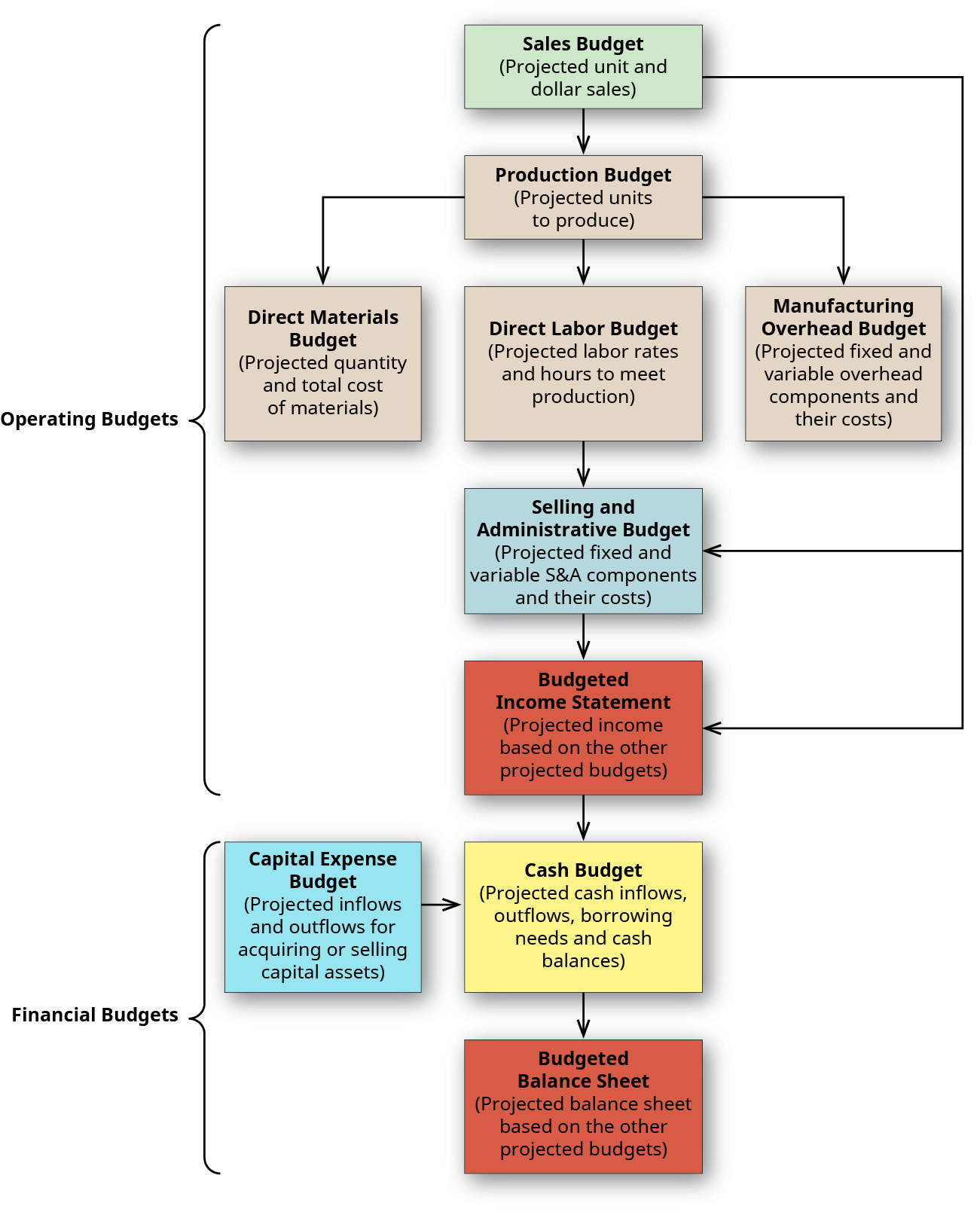

The operating budget shows the income-generating activities of the firm including revenues and expenses. The master budget includes the customer service marketing and all of the other departments individual budgets to create a single overall budget. Knowledge about your spending what you can do with the money you have.

The master budget is a comprehensive financial planning document. Information about what money you have coming and and going out. Within the operating and financial budgets it usually encompasses all of the lower-level budgets.

Furthermore what is the master budget and what are its major components. The purpose of master budget is that it helps in the future strategic and financial plan for the company. The master budget is a document that covers all aspects of financial planning.

Every aspect of the company operations is charted and documented for future predictions. The master budget contains interrelated financial plans to achieve strategic financial goals of a business. Its not there to trip you up its your budget its about making it work for you.

A master budget is an expensive business strategy that documents expected future sales productions levels purchases future expenses incurred capital investments and even loads to be acquired and repaid. This overall budget is known as master budget. The master budget serves as a motivation tool on the basis of which the employees can compare the actual performance with the budgeted performance.

The master budget is the planning tool that is used by the management to direct and judge the performance of the various responsibility centers Responsibility Centers The term Responsibility Center refers to a specific segment or unit of an organization for which a specific manager employee or department is held accountable and responsible for its business goals. The master budget is the most detailed and most heavily used budget in an organization. What is the master budget and what are its major components.

Make up a company and prepare a Balance Sheet for that company. Extra Credit Assignment 1. A master budget is the central planning tool that a management team uses to direct the activities of a corporation as well as to judge the performance of its various responsibility centers.

Budgets are prepared for each segment facet activity division of an organisation. A master budget collects all of the smaller budgets within your company and compiles them into one overarching budget so you can get a holistic overview of the business finances. The number one and main purpose of a budget is to give you information and knowledge.

The preparation of budget helps the company to identify the future financial need of the company. Commonly its thought that it is one large budget of the company. PURPOSE OF MASTER BUDGET The master budget is used to integrate and coordinate the functional areas within a companys operating activities provide a method of evaluating and controlling subsequently aspects of budget and it serve as a communicative device in which the staff contribute effort to the overall goals within an organization process.

With proper budgeting it can be easier to manage limited resources efficiently. However budgeting is also an important tool for decision-making monitoring business performance and forecasting income and expenditures. These activities segments are integrated into an overall budget for the entire organisation.

It is understood from the above two definitions it comprises the functional budget summaries as in the form of budgeted profit and loss account and budgeted balance sheet. The main purposes of budgeting are resource allocation planning coordination control and motivation. This budget is an integrated group of detailed budgets that together constitute the overall operating.

In other words the master budget includes all other financial budgets as wells as a budgeted income statement and balance sheet. The operating budget depicts the firms revenue-generating activities as well as its expenses. A budget is comprehensive ie all the activities and operations of an organisation are included in the budget.

It helps to forecast the future. The master budget includes the HR marketing and all other departmental budgets to produce an overall single budget. It usually includes all of the lower-level budgets within the operating budget and the financial budget.

What is the purpose of budgeting. Master budget is a summary of budget schedule in capsule form made for the purpose of presenting the highlights of budget forecast in one report. It usually consists of the budgeted income statement and balance sheet which represent a summary of the operational and finance budgets of the organisation.

The result is a budgeted income statement. It is used for planning and performance measurement purposes which can involve spending for fixed assets rolling out new products training employees setting up bonus plans controlling operations and so forth. It helps staff in getting job satisfaction as well as a good contribution to the growth of the business.

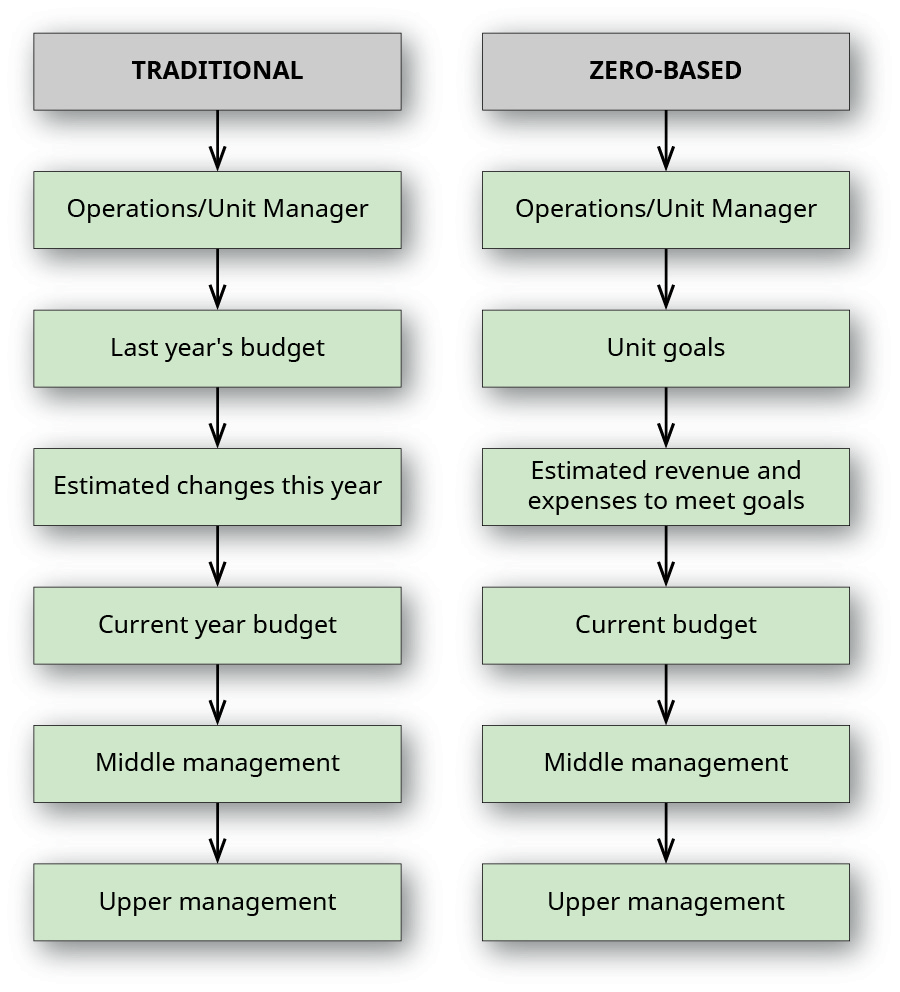

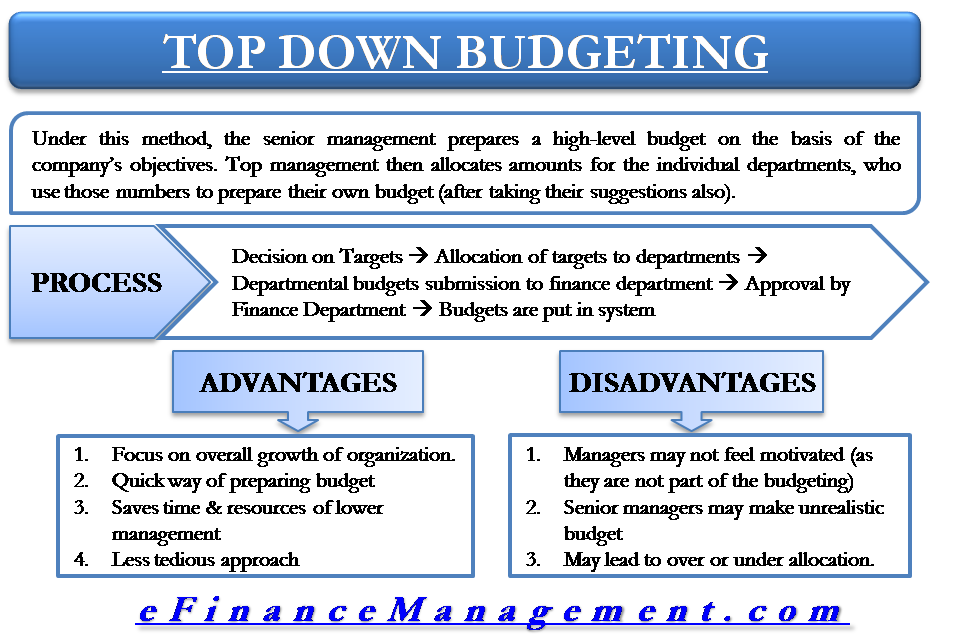

How does a top-down budgeting process differ from a bottom-up approach and what are the advantages and disadvantages of each. It is customary for the senior management team to review a number of iterations of the master budget and incorporate modifications until it arrives at a budget that.

The Master Budget Accounting For Managers

Describe How And Why Managers Use Budgets Principles Of Accounting Volume 2 Managerial Accounting

Master Budget Definition Examples What Is Master Budget

Prepare Financial Budgets Principles Of Accounting Volume 2 Managerial Accounting

Master Budget Capital Expenditure Cash Budget Types Of Budgets Youtube

7 2 Master Budgets Managerial Accounting

Budgeting Overview And Steps In The Budgeting Process

Preparing A Master Budget Accounting For Managers

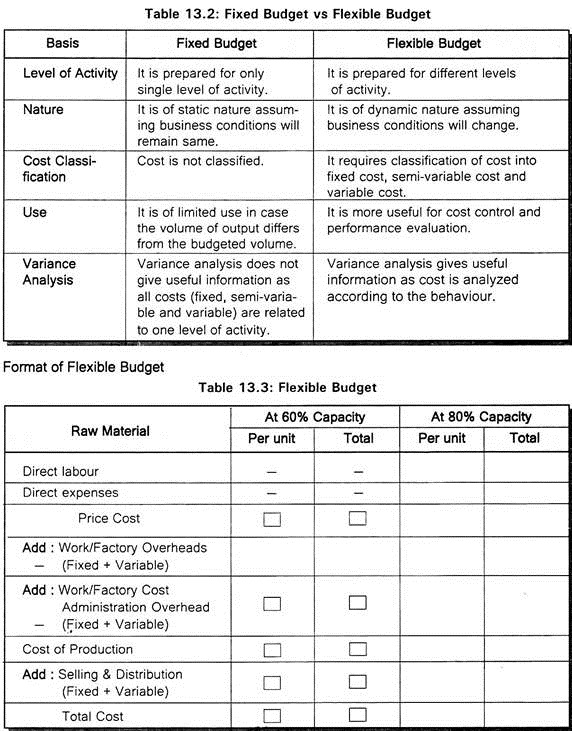

Difference Between Master Budget And Flexible Budget Compare The Difference Between Similar Terms

Difference Between Master Budget And Cash Budget Compare The Difference Between Similar Terms

Master Budget In Accounting Definition Components Example Video Lesson Transcript Study Com

Top Down Budgeting Process Advantages And Disadvantages

Types Of Budget In Accounting 25 Major Types

Describe How And Why Managers Use Budgets Principles Of Accounting Volume 2 Managerial Accounting

The Master Budget Accounting For Managers

Cost Management Accounting Strategy The Master Budget Part 1 Youtube

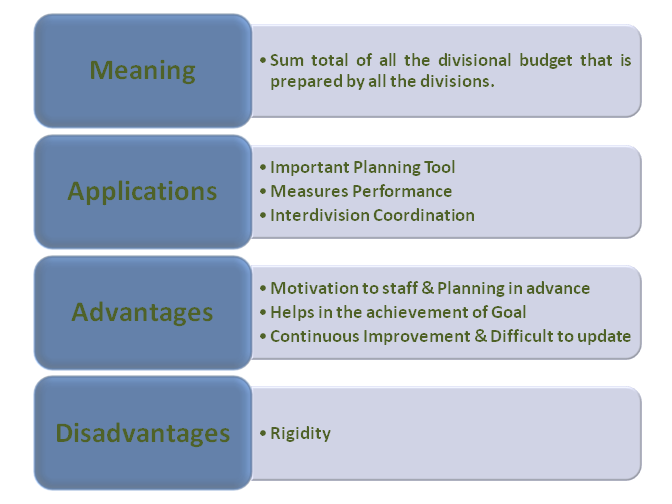

Master Budget Meaning Applications Advantages And Disadvantages

Comments

Post a Comment